Create a cash tracking account to keep track of the money held in stocks and shares.

Where the estate comprises of shares etc you only need to create one cash account in the name of the stockbrokers who will be dealing with those securities. This will enable you to keep track of the cash balance that they may be holding on behalf of the estate (for instance collecting dividends or proceeds of sale of shares).

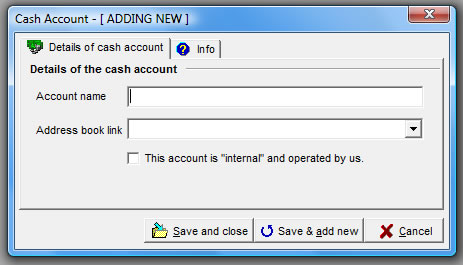

How to set up the cash tracking account for the stockbroker.

1. Go to 'Estate...Cash balances'

2. Click on 'Add a Cash Account'

3. Add the name of the Stockbroker in the 'Account Name' field

4. Leave the address link blank if you don't have an address set up for the broker

5. Don't tick the tick box for internal accounts as this will be treated as an external one

6. Click 'Save & Close'

Adding details of the share holding.

Shares, stocks etc. can be added through the Assets menu.

1. Go to 'Estate...Show list of assets'.

2. Click on 'Add an asset'

3. Complete the relevant boxes

4. Press 'Save & Close'

How to handle dividends.

If a dividend is received by the stockbrokers then the dividend will be entered in Probate Plus against the share giving rise to the dividend and the stockbroker’s cash account will be credited.

1. Go to 'Estate...Show list of assets'.

2. Highlight the Asset which has produced the dividend income.

3. Click on Record income' in the task panel or right-click on the asset and choose 'Record income' from pop-up menu.

4. Fill in the requested information.

5. Make sure the dividend is credited to the stockbroker's cash account

6. Press 'Save & Close'

How to record the sale of shares.

When a share is sold by the stockbrokers you will enter details of the sale in Probate Plus and credit the stockbroker’s cash account with the gross receipt.

1. Go to 'Esate...Show list of assets' .

2. Highlight the Asset which has been sold.

3. Click on 'Realise' asset in the task panel or right-click on the asset and choose 'Realise' from pop-up menu.

4. Fill in the requested information.

5. Show the proceeds of realisation as going into the Stockbroker's Cash Account.

Any costs incurred in connection with the sale of a share should be entered in Probate Plus as an administration expense (under 'Estate...Admin expenses...Add new admin expense') and the stockbroker’s cash account debited. Additionally, as part of asset realisation you can allocate costs against the asset realisation itself.

We strongly advise you not to take short cuts here for the sake of reconciliation at a later date. For example you could lump all the expenses together or merely enter a net figure of the sale proceeds. The stockbroker’s account will however set all the expenses separately and if you have made a mistake it is so much easier to reconcile the same entries.

None of the above entries will appear on the firm’s accounts. It is only when a cheque is received from the stockbrokers (either a final or interim payment) that the firm’s client account is credited.

At this stage using the “transfer between accounts” function the amount received will be transferred from the stockbroker’s cash account into the client cash account.

The only entry in the firm’s client account is to record the actual cheque received from the stockbrokers but all the entries behind that cheque will have been entered through Probate Plus and be capable of reconciliation through the cash accounts.

Further reading:

What to do when part of proceeds from sale of Shares is reinvested